Crafting an effective and cohesive marketing message is always challenging, but especially in 2023 as economic turmoil continues to shape spending behavior. However, for credit unions, these issues can be leveraged to form a compelling reason for consumers to leave their banks. Through strategic marketing efforts, credit unions possess the capability to not only address these consumer concerns, but ultimately build their trust and boost membership.

Credit Union Marketing Ideas That Answer Customer Questions

One of the best ways to appeal to new customers is to answer some of their burning questions. Here are the top concerns of 2023 that consumers are asking about — and how you can leverage your marketing as an educational tool to answer their questions.

1. How can I save more money?

With record-high inflation and growing consumer debt, people are trying to find ways to spend less and save more. Credit unions offer significantly more value than banks in this area — and all consumers need to do to benefit is open a new checking and savings account.

What to Do:

- Center your messaging around how your credit union is a non-profit organization, allowing you to prioritize members’ financial well-being rather than creating profits for shareholders.

- Call out lower operating costs and the ability to pass those savings on to members in the form of lower fees on checking, overdrafts, and other services.

- Tout higher interest rates on savings accounts, so any money members save does more for them in the long run.

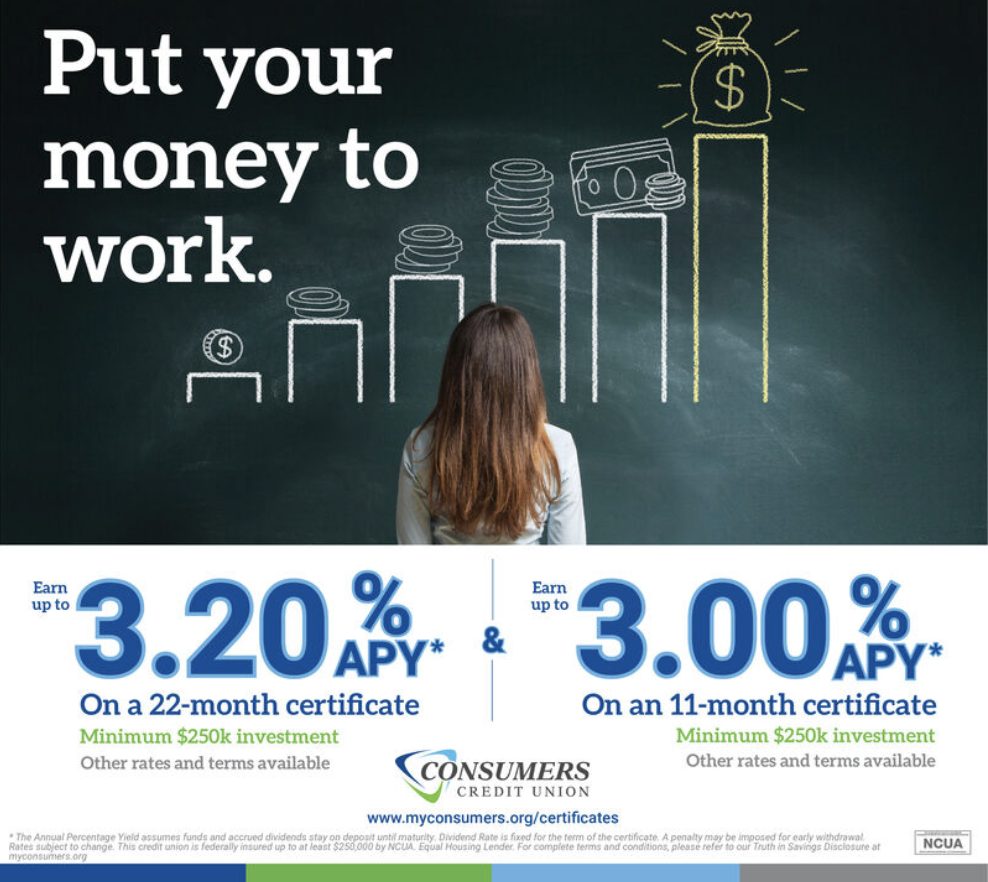

Consumers Credit Union put better interest rates front-and-center in this ad:

2. How can I support my community with my money?

With so much purchasing behavior and spending tied to big conglomerates, many consumers have become increasingly focused on shopping local. But with tightening budgets, this may not always be possible, given that small businesses often have higher prices.

What to Do:

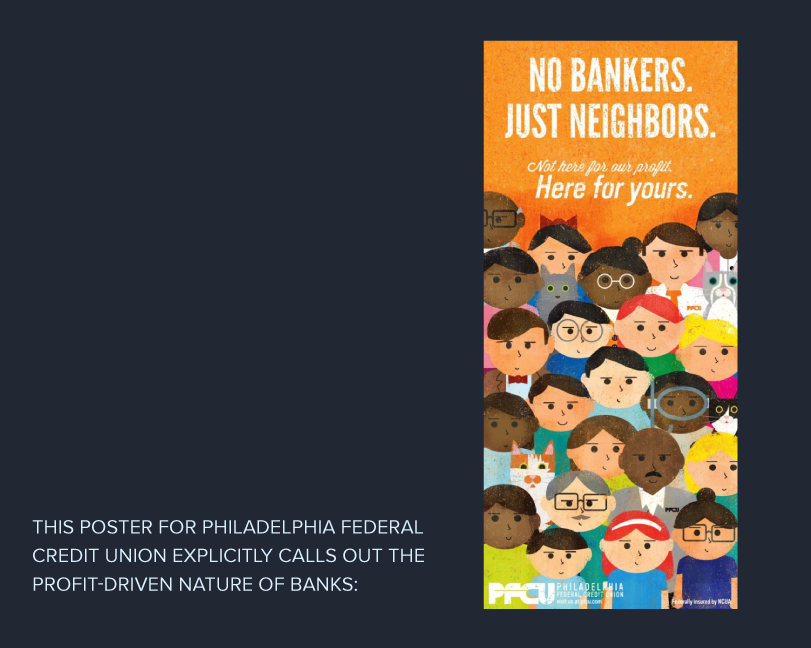

- Target this audience with ads about how credit unions are member-owned organizations that keep money local rather than sending profits to shareholders that live in financial capitals.

- Highlight how profits are inevitably reinvested in the community they serve in the form of educational scholarships, or support for local charities and organizations.

- Point out how business loans offer better terms and lower interest rates than big banks, spurring economic development in your region.

3. How can I invest my money ethically?

The idea of “voting with your dollars” has risen to prominence in recent years, encouraging consumers to stop buying from companies that support causes or engage in behaviors that are against their values. That goes for banks, too. Many activists have found that the financial institutions they’re trusting with their money could be funding industries that violate their personal ethics. For example, big banks are notoriously tied to fossil fuel companies.

What to Do:

- Directly target consumers who “vote with their dollar” by showing how credit unions are a way for consumers to divest from fossil fuels, as well as other “dirty” and unethical industries like weapons manufacturing.

- Highlight how credit unions are only able to invest in federal bonds, limiting their ability to invest in questionable industries.

- Tout the member-owned nature of credit unions and how that makes them more attuned to the values and ethics of their community, so members have more say in how their money is used.

This promotional video by Clean Energy Credit Union perfectly spells out the role credit unions can play in fossil fuel divestment:

Amplify Your Messaging With Power Marketing

Implementing these credit union marketing ideas is just one half of the recruitment battle. The other half is effectively amplifying your message to prospective members. Power Marketing has over two decades of experience executing sophisticated digital marketing and advertising campaigns in the financial services sphere, specifically promoting the value of credit unions like yours. If you need help with your recruitment efforts, get in touch with our team today.